Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Diperbarui • 2022-05-26

Inflation (= meaning the generalized and continuous increase of prices in an economy) is a very important economic phenomenon, affecting practically all investments in financial assets in the capital market. Therefore, for investors and traders alike it is highly recommended to understand the dynamics of inflation and some of its causes. One of the causes that influences inflation is the level of economic activity. When an economy is heated, with very low unemployment and a sufficient demand pressure, prices tend to accelerate, causing inflation. This also occurs due to pressure for wage increases in the labor market, which causes companies to transfer these costs to the prices of their products and services. This increase in wages and prices, if strong, can therefore cause inflation.

A second cause of inflation can be exchange rate devaluation. With exchange/currency devaluation, imports become more expensive, and this can lead to an increase in prices in the domestic market for products that depend precisely on imports from abroad, reflecting on the entire economy. With exchange appreciation, in turn, inflation tends to fall. A third cause of inflation is considered to be supply shocks, representing an increase in the prices of important inputs (such as commodities), which tend to affect the entire economy as well, such as gasoline and petroleum-derived fuels. In any case, what are the main indicators of inflation in an economy? Usually these indicators involve the so-called 'consumer price indexes' which are collected by the statistics departments of each country.

In the FBS economic calendar, our traders can find some important indicators regarding inflation:

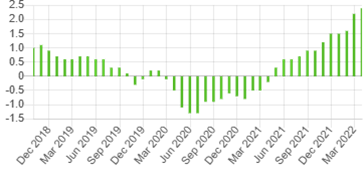

We see for example that the increase in the Swiss inflation rate between April 2021 (0.3%) and March 2022 (2.4%) appeared to have been (in part) a reflection of the devaluation of the franc (CHF) against its international peers, mainly the USD. In the chart below, we see the appreciation of the USD against the CHF in the period indicated.

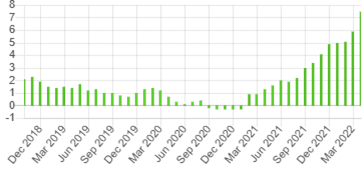

We see for example that the increase in the Eurozone inflation rate between January 2021 (0.9%) and March 2022 (7.5%) appeared to have been (in part) a reflection of the devaluation of the Euro (USD) against its international peers, especially the USD. In the chart below we see the devaluation of the EUR against the USD in the period indicated.

Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Dolar Australia menguat tipis di awal perdagangan akhir pekan ini, namun masih dalam tren penurunan. Pasar diperkirakan sepi karena memperingati Jumat Agung. Dolar AS menguat karena data ekonomi AS menunjukkan ekspansi,

Pasar saham Asia memiliki sentimen sideways dengan bias bearish pada perdagangan Kamis (28/03/2024), karena adanya sentimen ketidakpastian menjelang data indeks harga PCE AS..penjualan ritel Australia dirilis lebih kecil dari perkiraannya.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!